Record investment demand for gold in India will keep climbing as higher incomes spur buying even with the metal trading at an all-time high, according to Reliance Capital Asset Management Ltd.

“The rising middle class with higher purchasing power has started accumulating gold at all price levels,” said Sundeep Sikka, the Mumbai-based chief executive officer of the money manager, which operates the country’s second-biggest gold-backed fund according to Bloomberg data. “Demand is likely to rise as Indians become more and more prosperous.”

Increasing consumption in India, the world’s biggest gold user, may support prices rallying for an 11th consecutive year, as demand also surges in China. Investment demand in China more than doubled in the first quarter with the country overtaking India to become the largest market for gold coins and bars, according to the World Gold Council.

“Investment demand for gold in India has only gone up during the first half,” Sikka said. “Our interaction with major banks, jewelers indicates that demand was better than last year. We foresee robust demand for gold in the second half.”

Investment demand, consisting of bars, coins and bullion- backed funds, jumped 60 percent to 217.4 metric tons last year in India, and jewelry demand advanced 69 percent to 745.7 tons, according to the producer-funded World Gold Council.

Investment demand in the first quarter rose 8 percent to 85.6 tons in India, while it jumped 123 percent to 90.9 tons in China, the council said in a report in May.

UBS Sales

Assets in gold-backed funds in India climbed to a record 55.7 billion rupees ($1.25 billion) as of June 30, according to the Association of Mutual Funds in India. UBS AG said this week its physical sales to the country were 28 percent higher in the first half from a year ago.

Demand for gold as an investment will remain “upbeat” as the increasing number of exchange-traded funds have “caught the fancy of Indian investors,” said Anil Singh Thakur, associate vice president for commodity research at Gupta Equities Pvt.

“Rising gold prices shall attract gold demand and any sharp drop in prices shall be used as buying opportunity which we have witnessed as and when we have seen falls,” he said.

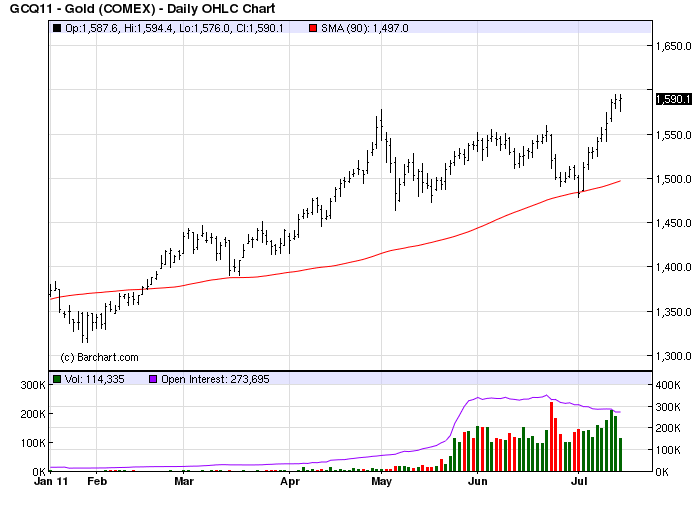

Gold for immediate delivery reached a record $1,578.72 an ounce today, while futures in New York reached an all-time high of $1,579.70, as investors sought protection against the European debt crisis, rising inflation and currency debasement. Prices are up 11 percent this year, after climbing the past 10 years, the longest run of gains in at least nine decades.

‘Confident Investors’

“Investors are more confident about higher gold prices given the current macroeconomic environment,” Reliance’s Sikka said by e-mail. “The longer-term outlook on gold remains bullish.”

Cash gold gained 0.3 percent to $1,572.95 an ounce at 5:34 p.m. in Mumbai. Futures in India reached a record 22,867 rupees per 10 grams today on the Multi Commodity Exchange of India Ltd.

Imports of gold and silver by India surged 200 percent to $17.7 billion in the three months through June, Commerce Secretary Rahul Khullar said on July 8. Spot gold prices averaged 26 percent higher in April-June from a year ago, while silver averaged 110 percent higher.

Gold demand in India reached a record 963.1 tons in 2010, according to the World Gold Council. Demand in April and May gained 10 percent to 11 percent from a year ago, after an 11 percent advance in the first quarter, Ajay Mitra, the council’s managing director for India and the Middle East, said on June 30. The council has yet to release second-quarter figures.

‘Tidal Wave of Demand’

“There’s a tidal wave of gold demand coming,” Jason Toussaint, the council’s managing director for U.S. and Investment, said June 14 at the Bloomberg Link Money Managers Conference in Boston. “A key is the long-term fundamental change in emerging markets. The biggest markets of growth are China and India.”

Demand in India may increase to more than 1,200 tons by 2020 as economic growth boosts incomes and household savings, the council said on March 31.

India entered the top 12 country rankings of millionaires for the first time in 2010, with 153,000, according to a report by Capgemini and Merrill Lynch Global Wealth Management last month. Salaries in India, the world’s fastest growing major economy after China, are set to rise the most in the Asia- Pacific region in 2011, an Aon Hewitt LLC survey showed March 8.